Excel is a great tool for financial questions and analysis, and one popular one is whether someone is better off paying down their debt vs adding to their savings. There are temptations to both, but this is where Excel can help identify a clear winner.

As much as it is a math question, it’s also a question about opportunity cost. If you’re paying down debt then you’ll incur fewer interest charges, and if you add to your savings then you can earn more in interest income. While both options will put someone in a better financial position, that doesn’t mean that one option isn’t better than the other.

Adding to Savings

Typically, banks pay interest rates of around 1% at best, unless there’s a promotional period. But generally, you aren’t making much when it comes to your savings. However, if you’ve got an amount of $5,000 to add to your savings, then that will produce an extra $50 per year at a 1% interest rate, or about $4.17 per month. It’s by no means huge, but it’s still incremental income that can help grow your savings over time.

Paying down debt

If you’ve got credit card debt, however, you’re probably paying anywhere from 15% to 20% in interest. There are exceptions, but most credit cards will likely fall within that range. On a credit card with an interest rate of 20%, that’s going to be an annual interest charge of $1,000 on a $5,000 balance. And so by paying down off a card at that rate, you’ll be saving a lot in expenses.

Difference in interest rates is key

It’s pretty clear that it all comes down to the difference in interest rates, and that’s why paying down debt will always provide you with more of a benefit than adding extra cash to your savings will. While it might be tempting to add to your savings, the reality is that you’ll likely be losing in the long run.

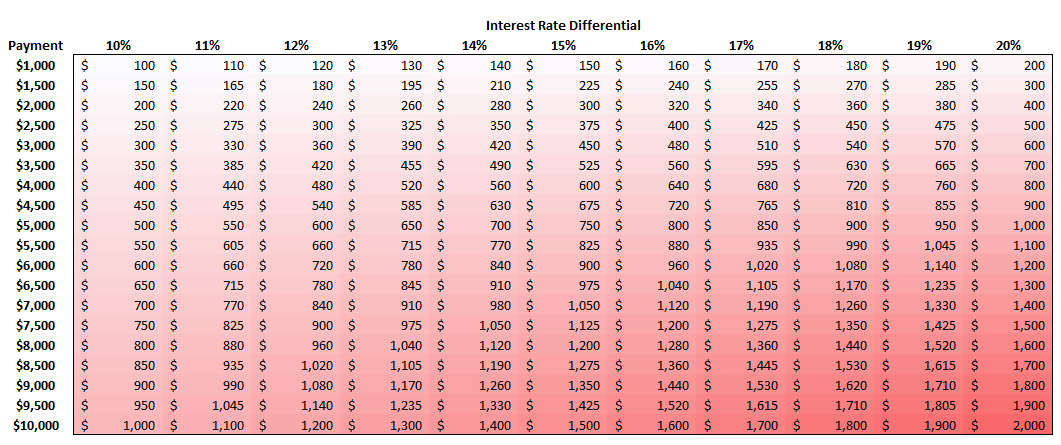

Using a color scale in Excel, I mapped out the difference in interest rates by the size of the possible payment. It’s a very linear relationship: the higher the differential and the higher the payment, the more money you’ll lose by putting money into savings rather than paying off debt:

In the example above, the difference in interest rates was 19% (20% in credit card rate less the 1% in savings rate). Multiplied by a $5,000 payment, that would have resulted in an annual loss of $950. Rather than avoiding $1,000 in interest charges, I would have made just $50 in interest income ($1,000 – $50 = $950 opportunity cost). On the matrix above, you’ll notice this is also the amount that is at the intersection of 19% and $5,000.

Summary

This isn’t the most groundbreaking discovery but it’s one that can be visualized well using Excel. After all, this is a numbers problem, nothing else. While some people may argue there are other reasons to add to savings such as having cash for a rainy day, the reality is that whether you add to your savings or free up room on your credit card, you can access funds from either option. And in the meantime, if you add to savings, you’re still incurring the interest charges. To make matters worse, the interest income you earn may be subject to income taxes, which will further erode the benefit of adding money to savings. Interest expenses on credit cards likely won’t be tax-deductible.

Overall, there really isn’t a strong argument for contributing to savings instead of paying down debt. It’s comes down to what interest rate you’re paying vs what rate you’re earning. And I’ve yet to see anyone earn more in interest than they’ve had to pay on a credit card.

The post is not a substitute for financial advice and is only intended to show how an analysis in Excel can be done when comparing two different options – in this case, paying down debt vs contributing to savings.

You can download the file that I used in these calculations here.

If you liked this analysis on Paying Off Debt vs Adding to Savings, please give this site a like on Facebook and also be sure to check out some of the many templates that we have available for download. You can also follow us on Twitter and YouTube.

Add a Comment

You must be logged in to post a comment