Credit card interest is a cost that cardholders incur when they carry a balance beyond the grace period, which is typically between 25 to 30 days after a billing cycle ends. This interest is calculated based on the Annual Percentage Rate (APR) provided by the credit card issuer. Understanding how this interest is computed is vital for managing financial liabilities and making informed decisions. This article goes over how to calculate credit card interest in Excel, in a step-by-step process.

Getting the correct rate

Before we get started, they key is finding out what your APR is. This is a yearly interest rate which is provided by credit card companies. It tells you how much you’ll be paying. The APR is usually stated in the credit card agreement or on the credit card statement. It’s essential to note that different transactions may have varying APRs; for instance, cash advances often have higher APRs compared to purchases. If you have cash advances to consider that are at difference rates, then you may need to break this out into two separate calculations.

Once you have APR, you need to convert that into a daily rate as credit card interest is usually calculated on a daily basis. To calculate the Daily Periodic Rate (DPR), this involves taking the APR and dividing it by 365.

DPR = APR / 365.

This can involve a lot of decimal places so you may need to do some rounding. But if you do this in Excel, you don’t have to, and that means a more precise calculation.

Calculating your average daily balance

To determine your interest expense, you’ll also need to determine what your balance was during each day that fell within your billing cycle. To calculate the Average Daily Balance (ADB), sum up the total of those daily balances and divide it by the number of days. The formula is the same as if you were to calculate any average:

ADB = Sum of daily balances / Number of days in billing cycle

It’s important to note that you’ll also need to carry over any balance from your last bill if it was unpaid. And you’ll also want to deduct any payments you make from the balance and add any purchases to ensure the balance is always correct and up to date.

Calculating the interest charge

To get your daily interest charge, simply multiply the two variables, DPR and ADB by one another.

Daily interest charge: DPR x ADB

And if you want to calculate the monthly charge, then you take the daily charge and multiply it by the number of days in your billing cycle.

Monthly interest charge = Daily Interest * Number of days in billing cycle

Creating a template to calculate monthly interest costs in Excel

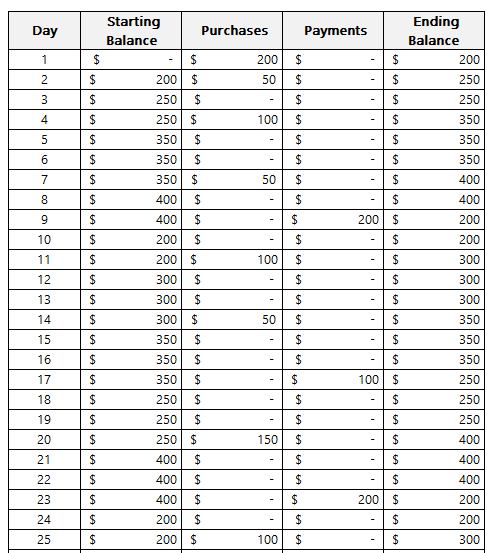

Now it’s time to create a template in Excel which will make it easy to adjust for different scenarios. First off, we need to get the daily balances in a table format. Ideally, there should be a column for the starting balance, the day, purchases, payments, and the ending daily balance. This way, you can easily account for purchases and payments should you want to determine what your balances and interest expenses will be ahead of time.

The formula for the ending balance will be as follows:

Ending balance = Starting balance + Purchases – Payments

In the above example, the assumption is you start with a starting balance of 0. However, if you’re carrying over a balance from the previous period, then you can enter it in the starting balance.

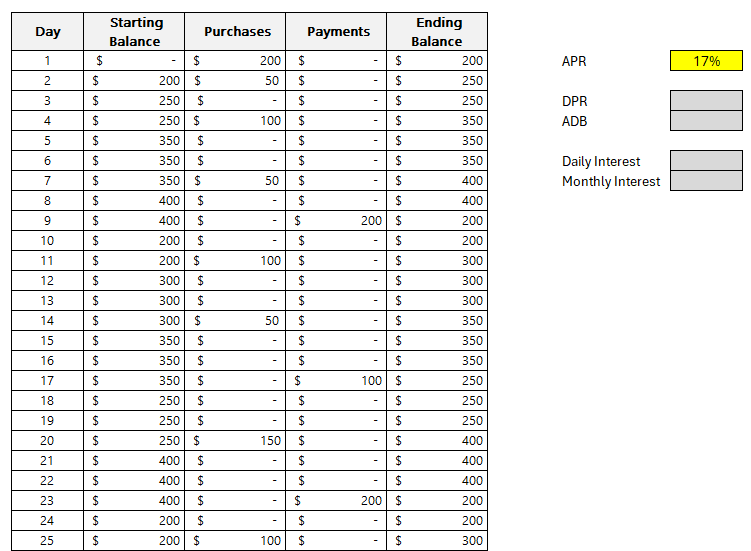

Next, we need to enter the APR. Refer to this page on how to calculate APR. In this example, I’m going to use a rate of 17%. Here’s how my template looks thus far:

The values highlighted in dark grey are reserved formulas while the yellow cell pertaining to APR indicates that this is value that requires manual entry.

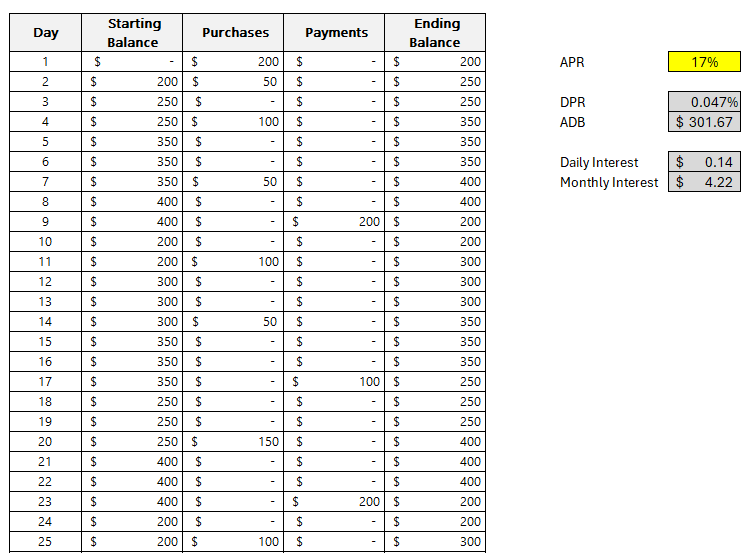

The formula for DPR just needs to reference the APR and divide it by 365:

DPR = APR/365

This returns a value of approximately 0.047%.

This will also have a named range of DPR to make it easier to reference later on. The benefit of using Excel for these calculations is that they will be more accurate; there’s no need to do any rounding.

For the ADB, a simple AVERAGE function can be used on column F, which in my spreadsheet, contains the ending balances.

ADB = AVERAGE(F:F)

The average in my spreadsheet is a value of $301.67.

Since there is nothing else in column F, we can just average everything that’s in there. The function will ignore any blank values. This will be another named range, ADB.

To calculate the daily interest, the formula will should look familiar, this time, it’s within Excel as this involves named ranges:

Daily Interest = DPR * ADB

This returns a value of $0.14 (rounded).

Lastly, to collect monthly interest we take the Daily Interest and multiply it by the number of days. For this example, I’ve set a named range of DailyInterest. And to calculate the number of days, I can use the following MAX formula to get the largest value in column B, which has the day numbers:

=MAX(B:B)

There are 30 days within the billing period in my example.

Then, this gets multiplied by the DailyInterest named range to arrive at the total monthly interest cost. Here is the full formula within the cell for Monthly Interest:

Monthly Interest =MAX(B:B)*DailyInterest

The monthly interest in my example computes to $4.22.

Understanding this process sheds light on the significance of the APR and how maintaining a lower balance or paying off the balance before the end of the grace period can mitigate the interest charges. It also underscores the importance of being aware of the different APRs for various types of transactions.

Many credit card issuers offer a grace period during which no interest is charged on new purchases if the previous month’s balance was paid in full. Utilizing such grace periods effectively can lead to substantial savings on interest charges.

If you liked this post on How to Calculate Credit Card Interest, please give this site a like on Facebook and also be sure to check out some of the many templates that we have available for download. You can also follow me on Twitter and YouTube. Also, please consider buying me a coffee if you find my website helpful and would like to support it.