If you’ve ever looked up historical stock prices on Yahoo Finance, you know that there is both a closing price and an adjusted closing price. Sometimes the values are the same, but sometimes there’s a difference In this post, I’ll cover why that happens, and how you can calculate the difference yourself.

What is the difference between the two prices?

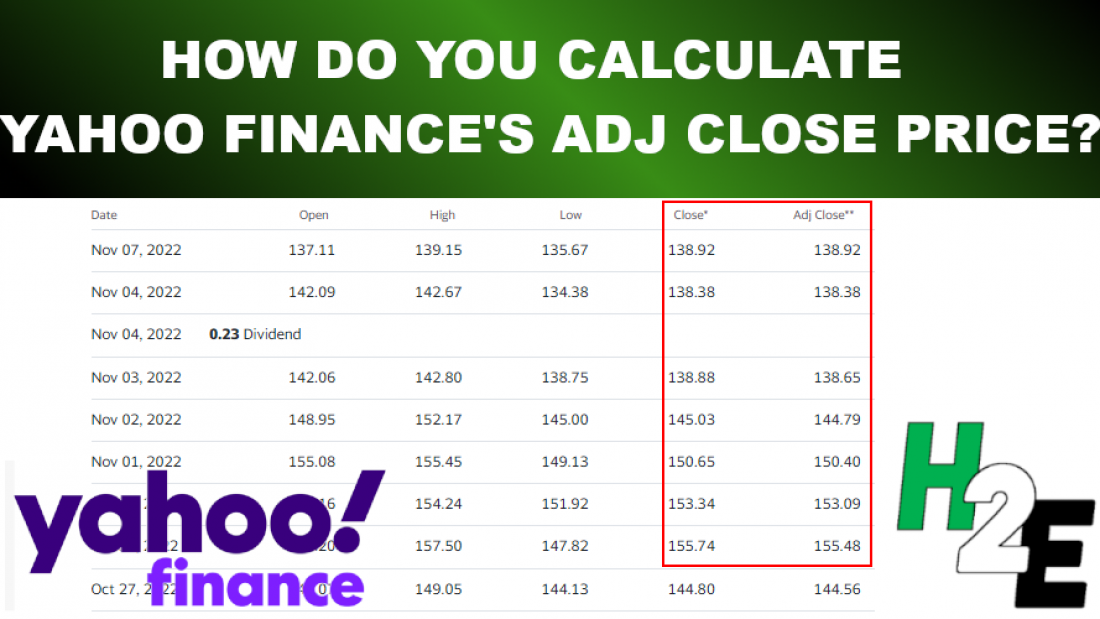

The adjusted closing price in Yahoo Finance factors in the impact of dividend payments. For stocks that pay dividends, the further back you go, the greater the difference there will be between the close and the adjusted closing price. With the closing price, you’ll just see the raw change in price, whereas the adjusted closing price will also factor in the dividend, and that can give you a better view of how the stock’s total returns have been over time, not just from the increase in share price. And thus, the longer of a duration you’re looking at and the more dividend income along the way, that creates more of a gap between the close and adjusted close.

For stocks that don’t pay dividends, there will be no difference between these two values.

How to calculate the difference

A difference between the two prices in Apple’s stock history doesn’t show up until the last time it issued a dividend, on Nov. 4. Technically the company didn’t pay the dividend on that day, but that was the date of record for the dividend, and so investors who owned the stock at that date were eligible for the dividend. The actual payment took place later, on Nov. 10.

To factor in for this difference, we need to take the amount of the dividend ($0.23) and divide it by the stock’s price immediately before this date. On Nov. 3, the stock price closed at $138.88. Taking $0.23 and dividing it by the stock price returns a value of 0.001656. If we take 1 minus that amount, that equals 0.99834389. That’s what the closing price needs to be multiplied by to arrive at the adjusted close. Here’s how it looks in the spreadsheet:

That ‘dividend impact’ factor will be applied to every value before the dividend. And when doing that, you arrive at the adjusted closing price. However, that’s not the end of this because if we go to the next dividend in August, the values are off again:

The issue here is that we need to factor in another dividend payment. It’s another payment of $0.23 and this time the stock price was $165.81. The discount factor is now 0.99861287. However, this needs to be multiplied by the first discount factor as well, in order to ensure we are adjusting for both dividend payments. And so the correct factor is 0.996959:

You would need to continue to make these adjustments the further back in time you go, and each time, taking into account all the dividend payments in-between today and the date of the stock price on that day. This is why over time, the difference gets larger.

If you liked this post on How to Calculate Yahoo Finance’s Adjusted Closing Price, please give this site a like on Facebook and also be sure to check out some of the many templates that we have available for download. You can also follow us on Twitter and YouTube.