Want to estimate how much you might owe in taxes next year? If you are self-employed or have other income besides what you get from an employer, then you may find it useful to plan ahead of time and determine how much you might owe to ensure that you are putting aside enough money for taxes. It’s not a fun process but it can save some headaches later on. The good news is that Excel can make that process easy. Below, I’ll show you how you can calculate and estimate your taxes in Excel. And if you’d just prefer to download the file that I have created, scroll to the bottom of this page.

Determining your marginal tax rate

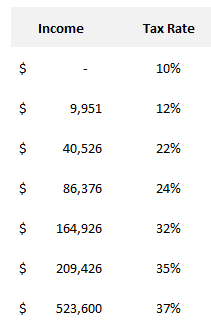

To estimate your taxable income and marginal tax rate, the first thing you’ll need is a table for the tax brackets. For this, I will use the schedule for federal income tax brackets 2021 found here.

I can’t simply copy the table into Excel as I will need to format it a little differently (the values contain text and won’t be helpful if I need to do a lookup). The table needs to be organized by income threshold rather than tax rate. This is how I have set it up in Excel:

To make this table easier to reference to, I am going to create named ranges for these tax brackets plus the income I am going to enter in. This will make it easier to follow along.

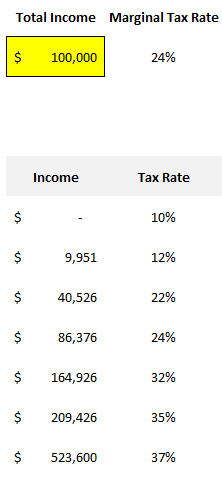

If I want to look up the incremental tax bracket for a given level of income, I can accomplish this using a VLOOKUP formula. This is the formula I would use to accomplish that:

=VLOOKUP(Income,TaxBrackets,2)

What it is doing is taking the income number, and looking up the tax bracket table, and pulling in the second column (the tax rate). The VLOOKUP formula doesn’t look for an exact match (as I have left the last argument empty) and it will pull the closest number without going over. This is where it’s important to put in the numbers that the tax bracket start at, rather than a range. Using this formula, it correctly tells me that income of $100,000 would be at the 24% tax bracket as it does not yet reach the minimum amount for the next bracket — $164,926:

That tells me the correct tax bracket but I still need to calculate the taxes that are due at each level, which I will cover in the next section.

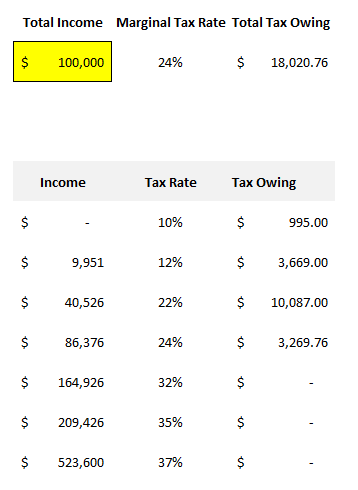

Determine how much you owe at each tax bracket

For the first tax bracket, I will need to determine if the income level reaches the second tax bracket. If it does and the income is at least $9,951, then I can multiply that by the tax rate of 10% as that would be the maximum that can be taxed at the first bracket — 9,951 x 10%. If the income is not at least $9,951, then I just multiply the total income by the tax rate. Here is what the formula looks like using named ranges:

=IF(Income>=IncomeLevel2,IncomeLevel2-IncomeLevel1,Income)*TaxRate1

For the second tax bracket calculation, I can follow similar logic. I will multiply the difference between the start of the third and second income levels. Here’s how that calculation looks:

=IF(Income>=IncomeLevel3,IncomeLevel3-IncomeLevel2,MAX(0,Income-IncomeLevel2))*TaxRate2

I also use the MAX function just in case there is a negative number (where the income doesn’t even reach the next level). The same logic can now be applied for all of the remaining tax brackets except for the last one. Like the first one, it needs to be calculated differently. In that case, I just need to know if the income is above that threshold. And if it is, I take the difference between it and the total income, and multiply it by the highest rate:

=IF(Income>=IncomeLevel7,Income-IncomeLevel7,0)*TaxRate7

If the income isn’t above the last level, then I put a 0 and multiply that by the tax rate. Now, when I’m all finished, I can sum up the tax owing at each level and come to a total tax number that would be due based on a given income number:

At this stage, you could now decide to deduct how much you may have already paid in taxes and any deductions or credits that you are entitled to.

But I’m not going to go any deeper here because there are too many different variations from one country and jurisdiction to the next when it comes to taxes. However, this should at least give you a good starting point for doing the rest of your estimation, however detailed you want it to be. But by at least estimating the taxes owing and deducting how much you have already paid, you should have a good idea of how much you might owe come tax time, under a worst-case scenario.

If you’d like to just download the file that I created when making this post, you can do so here.

If you liked this post on How to Calculate Taxes in Excel, please give this site a like on Facebook and also be sure to check out some of the many templates that we have available for download. You can also follow us on Twitter and YouTube.

Add a Comment

You must be logged in to post a comment