What is a tax-free savings account (TFSA)?

A tax-free savings account (TFSA) is a very useful tool for Canadian investors to shield investment gains and dividend income from taxes. However, it can be challenging to keep track of the rules and just how much you’re able to contribute and what your TFSA limit is for the year.

How much can I contribute to my TFSA in 2025?

For 2025, the annual contribution limit for the Tax-Free Savings Account (TFSA) is $7,000. This amount is set by the federal government and can increase over time due to indexation for inflation. If you were at least 18 years old in 2009 (the year the TFSA was introduced) and have never contributed, your total available contribution room as of 2025 would be $102,500. That total includes all annual limits from 2009 through 2025. Your personal contribution room may be lower if you’ve contributed in previous years, or higher if you made withdrawals in earlier years, since withdrawals get added back to your room at the start of the following calendar year.

It’s important to note that unused contribution room carries forward indefinitely, so you don’t lose it if you don’t max out your TFSA each year. This flexibility makes the TFSA one of the most powerful investment vehicles for Canadians, since it allows you to plan contributions around your cash flow without worrying about missing out on available room. To confirm your personal TFSA limit, you should always check your CRA “My Account,” as financial institutions don’t track your overall contribution room across multiple accounts.

Do TFSA withdrawals increase my contribution room?

Yes, TFSA withdrawals do increase your contribution room — but not immediately. Any amount you withdraw from your TFSA is added back to your contribution room starting on January 1 of the following year. For example, if you withdraw $5,000 in 2025, your contribution room for 2026 will increase by $5,000 on top of your regular annual limit. This feature makes the TFSA highly flexible, since it allows you to use the account both for long-term investing and for shorter-term goals where you may need access to your funds.

The key detail to remember is that you cannot re-contribute the withdrawn amount in the same calendar year unless you already have unused room available. Re-contributing too early would result in an over-contribution, which is subject to a penalty tax of 1% per month on the excess. To avoid this, it’s best to track your contributions and withdrawals carefully — or use a TFSA tracker — so you know exactly when that room becomes available again. This rule is one of the most common sources of confusion among Canadians, so understanding the timing is essential to getting the most out of your TFSA.

What happens if I over-contribute to my TFSA?

While it may seem simple to track your balance, there’s one issue that can cause headaches for TFSA holders, and that’s when it comes to withdrawing funds. One of the advantages of a TFSA is that since the funds that are contributed are after-tax, you don’t incur any penalties for taking money out. Unlike with an RRSP, you don’t have to worry about a withholding tax. With a TFSA, you can freely move money in and out of your accounts as you need it.

The caveat, however, is that when you withdraw funds, the contribution room isn’t replenished until the beginning of the next calendar year. And so if your TFSA had been maxed out on July 1st and you had withdrawn $10,000, then that will free up contribution room –- but it won’t be until January 1st. Any withdrawals that are made, regardless of the time of the year, won’t free up space until the beginning of the next calendar year.

That’s where much of the complexity comes into play when it comes to TFSAs. While contributions will reduce your available contribution room immediately, withdrawals won’t make that room available until next year. That lag can create many problems for TFSA holders. That lag can give people the misleading impressing that they have contribution room since they recently took money out, and that’s where overcontributing can happen very easily.

Suppose your TFSA is maxed out (2025 cumulative balance is $102,000) and you pull all the funds out today and they re-contributed them immediately after. In this scenario, you’ve now overcontributed by the entire balance -– meaning you’ll get a 1% penalty on that entire amount, which would amount to $1,020. And that’s just for one month. Leave that overcontribution in your TFSA and those penalties will pile up quickly.

While that may not be a common scenario that will take place, it’s an extreme example that helps to demonstrate just how costly it can be to make a very simple mistake. That’s why simply tracking the balance and looking at contributions and withdrawals is not enough, TFSA holders need to factor in the lag that happens with withdrawals. It’s a small but important detail that can make a big difference in determining how much contribution room you have available.

What this template will help you do

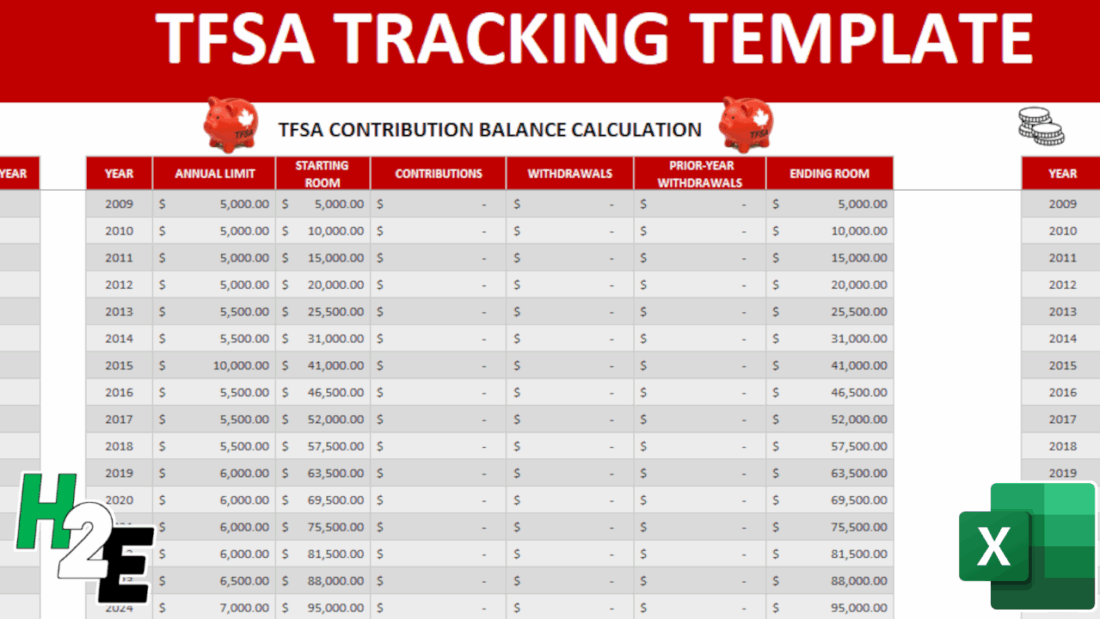

The purpose of this template is to help you keep track of both the contributions you make to your TFSA as well as the withdrawals so that you know what your limit is in a given year. If you’ve got multiple TFSAs and they aren’t all at one financial institution, keeping track of all your transactions can be a challenge. That’s where a spreadsheet can come in very handy; having all your information all in one place can make it much easier to stay on top of your TFSAs.

By logging your transactions each time you make a withdrawal or contribution from one of your TFSAs, you can have a complete picture of your balance at any given time. There’s no limit to the number of transactions you can enter in the template, and this can be used for a running total — forever. And with no macros and a simple, easy-to-use interface, the goal of this template is to make the process as painless as possible.

Use this template to track your TFSA limit

The template itself is very simple to use. There’s an area to enter any TFSA transactions, and while you can start from your first year of eligibility, if you know the contribution room you have as of the start of a specific year, you can start from there.

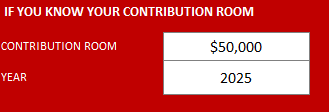

In the header, there is a section where you can specify your contribution room and the year. If for example you’re starting 2025 and you know the contribution room you have is $50,000, this is how you’d enter it:

Upon doing so, the template updates to show the starting room as per that year.

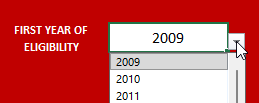

You can, however, start the calculations from your first year of eligibility by selecting from the drop-down list in cell R2:

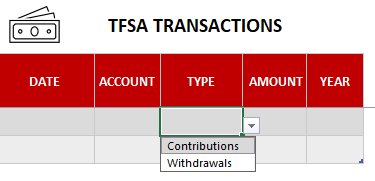

Next, you can specify any contributions and withdrawals from the TFSA transactions table. If you have multiple TFSA accounts, you can enter the specific one in the account tab. The template will total all of the transactions, making it easy for you to stay on top of your total contributions and withdrawals, regardless of which account they originated from. You can keep adding to the list of transactions as you need to and the table will continue expanding.

All the amounts are to be entered as positive. The type of transaction will ensure that the transaction is put into the correct column and update the balance calculation correctly.

What if I go over my TFSA limit?

If the value in ending room field goes negative and indicates that you have overcontributed to your TFSA, the amounts will be highlighted in red (see below). That being said, just because it hasn’t highlighted in red doesn’t mean you’re safe. You should use this as a guide and not an absolute indicator of whether you’re okay or not.

Planning makes perfect

Even if you haven’t made any transactions during the year, what you can do is to enter transactions you expect, or plan to make. Especially if you’re expecting to withdraw funds, you’ll want to budget for that in this template to ensure that it won’t cause a problem for you. Doing some planning beforehand can help prevent problems down the road, and save some costly surprises.

Checking your data

One of the most important things that you can do is to verify that your data is correct.

When in doubt, your best bet is to confirm with the CRA. If you have My Account setup for access online, what you can do is access your balance as of the beginning of the year. While it won’t have all the contributions and withdrawals that you have made since the start of the year, you will have information on your available room as of January 1. This will at least give you a number that you can use as a starting point and then after factoring in your transactions, you can determine what your up-to-date balance is.

Downloading the file

As always, if you want to go ahead and try the file out just keep in mind there are no guarantees that come with it and that when in doubt, you should always verify your information with the CRA especially when it comes to determining how much room you still have available.

Here’s the link to download the TFSA template

The template will not factor in penalties and ultimately the accuracy of it will depend on how up to date your recordkeeping is.

The TFSA Contribution Tracker Spreadsheet is completely free of charge with no limitations. If you like it, please give this site a like on Facebook and also be sure to check out many other templates that are available for download. You can also follow us on Twitter and YouTube.

Add a Comment

You must be logged in to post a comment