If a stock you invested in dropped in price, it could be a good opportunity to buy more shares and bring your average down. You can use the average down calculator on this page to do a quick what-if calculation to determine how many more shares you would need to be. However, you can also use this template, which will allow you to run through the same scenarios within Excel.

How the average down template works

There are only six inputs on this template:

- Amount invested

- This is how much money you have already invested into the stock.

- Shares owned

- The number of shares that you own.

- Current share price

- What the share price is.

- Desired average price

- What price you want to average down to.

- Budget

- How much money you can afford to invest.

- Increment price by

- This is for the sensitivity analysis and determines by how much you want it to move by. The default is set to $0.50.

Once you’ve entered that data, the rest of the template will populate. Here are the two scenarios that it will show you:

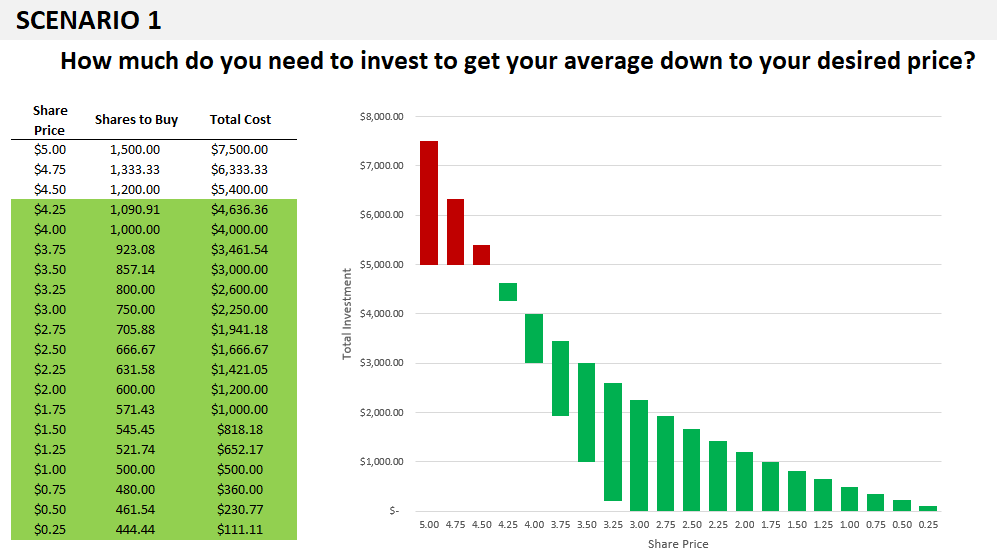

1. Getting to your desired average price

In this scenario, the template will show you how much to invest at different price points to get your average down to your desired average price. You will see up to 20 different data points to show you if the price continues to get lower, how many shares you will need to buy to reach the average price you are targeting.

And any scenarios that fall within your budget will be highlighted in green, and so will the corresponding chart:

If all the data points aren’t filled in or it looks like the chart doesn’t go all the way to the right, this is a sign you need to fix your Increment Price by value. Enter a smaller price increment and you’ll see more data points and a more complete chart.

2. How low you can get your average

The second scenario ignores the desired average price and simply tells you the different average prices you can average down to if you buy at the current price. This is good if you don’t have a specific average in mind and just want to see how low you might be able to go.

You’ll notice on the x-axis it refers to the average price rather than the share price in the earlier chart.

Please note that the template is locked down and this is to prevent overwriting formulas which could lead to errors in the calculations and the charts.

Download the file

You can download the file for free, from here. The free version is limited to five price points. On the full version, there are 20 different prices, no ads, and there are more scenarios:

If you liked this Average Down Calculator Template, please give this site a like on Facebook and also be sure to check out some of the many templates that we have available for download. You can also follow us on Twitter and YouTube.

Add a Comment

You must be logged in to post a comment