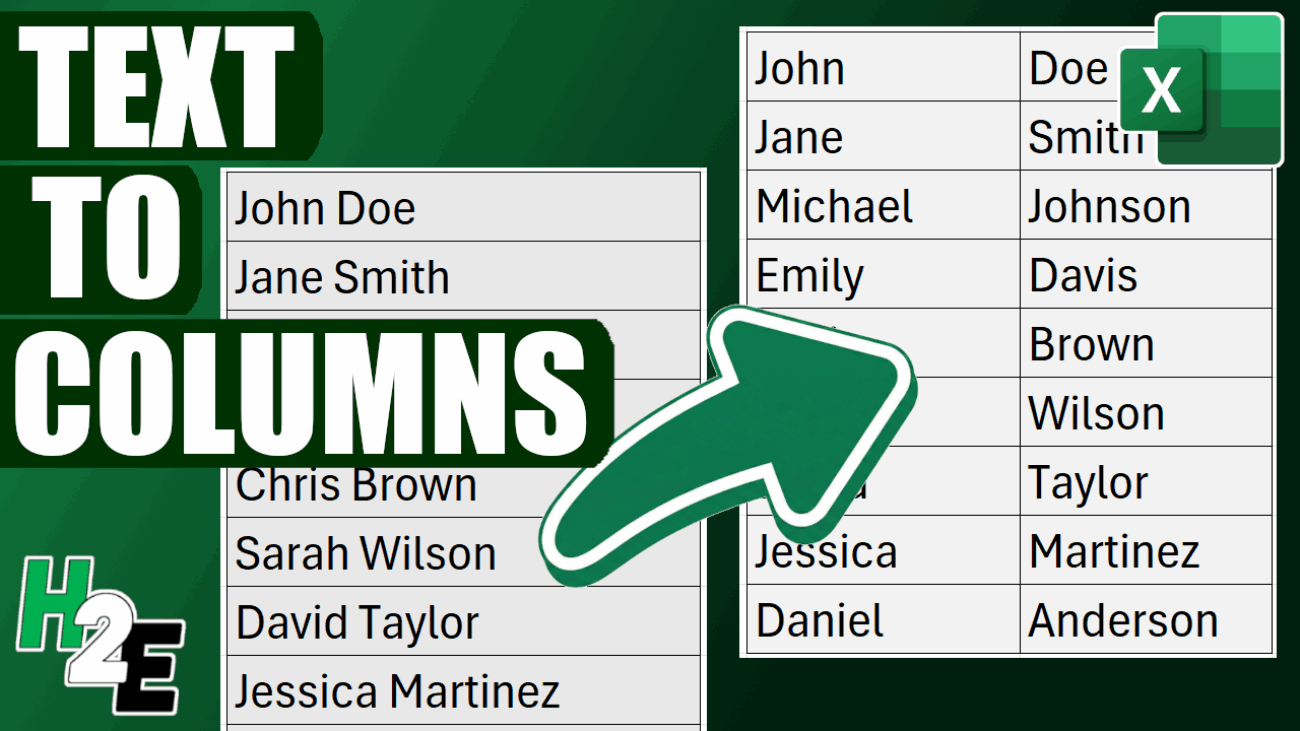

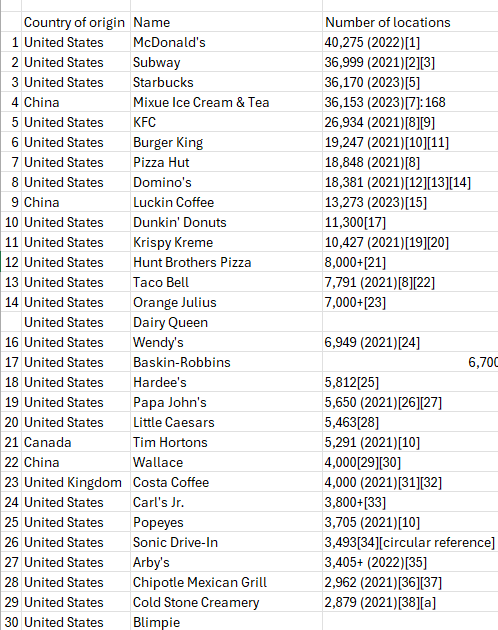

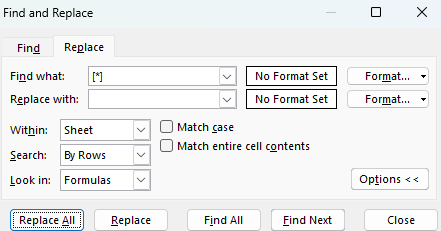

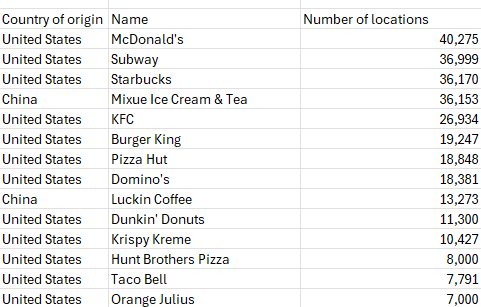

Are multiple fields taking up just a single column in your Excel spreadsheet? This is a common issue when working with data from an external source. But manually retyping data into separate columns is tedious and error-prone. Fortunately, Excel offers a powerful feature designed exactly for this problem: Text to Columns. In this guide, I’ll walk you through how to use the Text to Columns wizard, and if you’re using the latest version of Excel, I’ll also show you other ways you can convert your text into multiple columns.

What is “Text to Columns” in Excel?

Text to Columns is a built-in Excel tool that splits a single cell of text into multiple cells based on a specific boundary. This boundary is usually a character (like a comma or space) or a fixed position in the text.

Common use cases include:

- Splitting full names (John Doe) into First Name (John) and Last Name (Doe).

- Separating product SKUs (Item123Red) into ID, Batch, and Color.

- Cleaning up data exported from CSV files or database software.

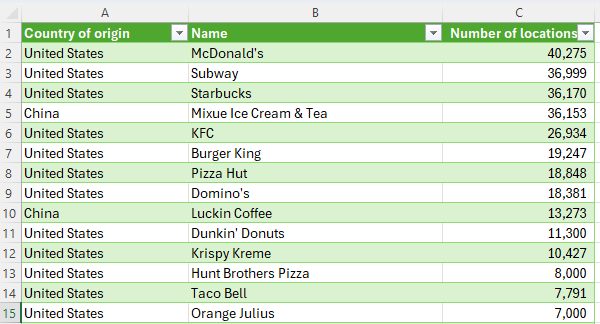

Method 1: Using the Text to Columns Wizard (Delimited)

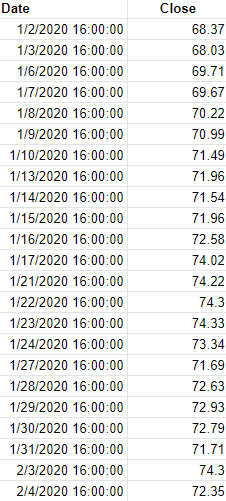

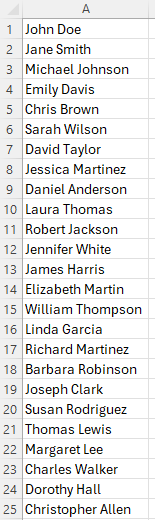

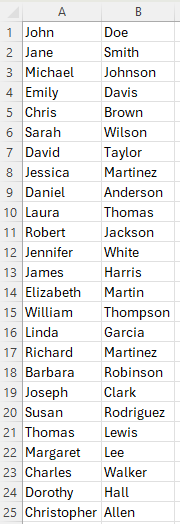

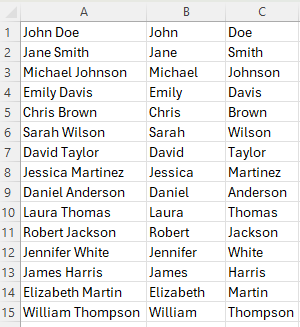

This is the most common method. You use this when your data is separated by a specific character, known as a delimiter (e.g., commas, tabs, semicolons, or spaces). In the following example, I have a list of values in one column showing first and last name. I am going to break it out so that first name is in one column and last name is in another.

Step 1: Select Your Data

Starting by highlighting the range of cells containing the text you want to split.

- Pro Tip: Ensure the columns to the right of your data are empty. Excel will overwrite any existing data in those cells.

Step 2: Open the Wizard

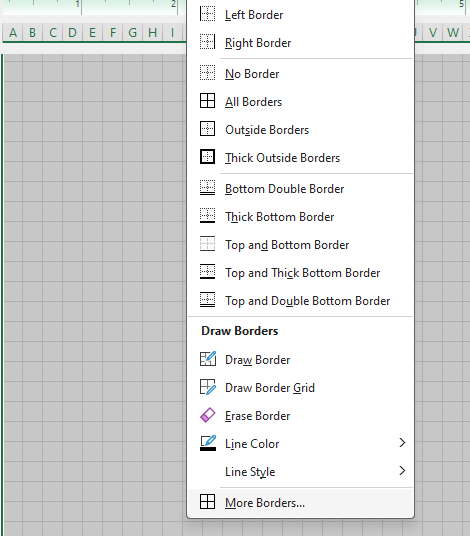

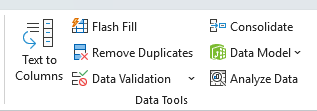

Go to the Data tab on the Ribbon and click Text to Columns in the Data Tools group.

Step 3: Choose “Delimited”

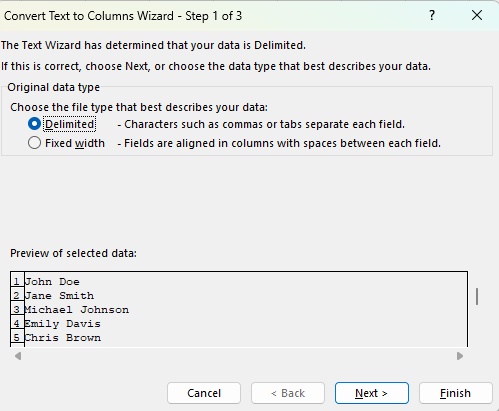

A wizard window will pop up. Select Delimited and click Next.

- Pro Tip: Unless you always need to split a cell in the exact same place each time, you won’t need to use the Fixed Width option.

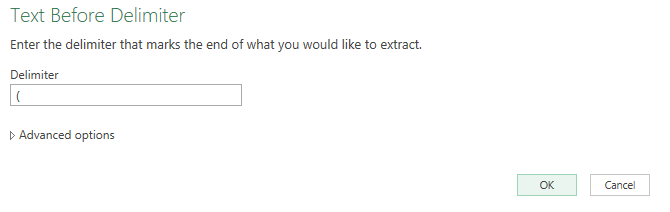

Step 4: Select Your Delimiter

Check the box that matches how your data is separated.

- If your data looks like

Doe, John, check Comma. - If your data looks like

Doe John(as it does in the example above) check Space. - You can see a preview of how your data will be split in the Data preview window at the bottom. If it looks okay, click Next.

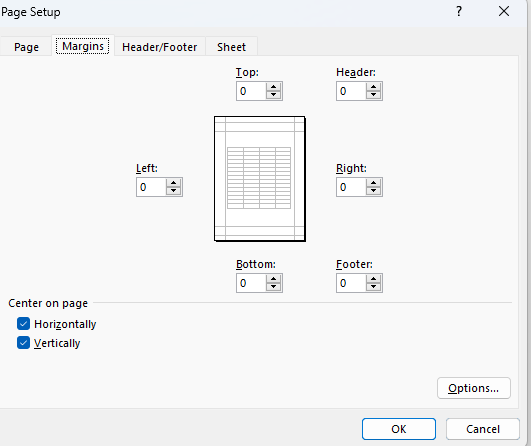

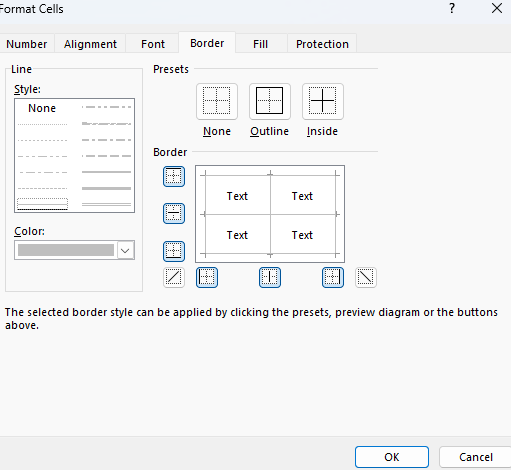

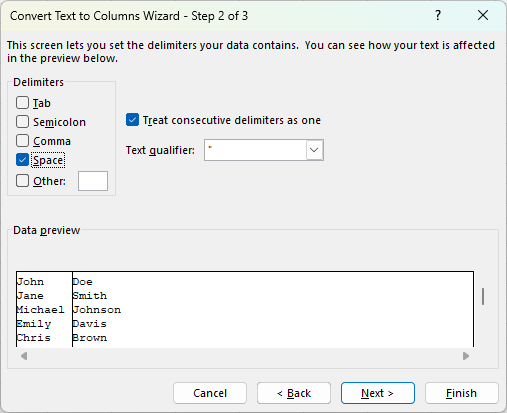

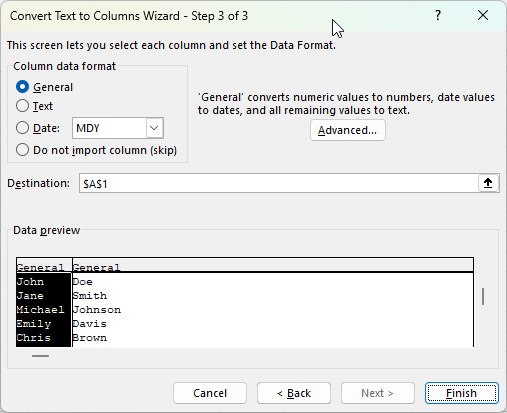

Step 5: Format and Finish

In the final step, you can choose the data format (e.g., Text or Date) for each column.

- Destination: By default, Excel overwrites the original column. If you want to keep the original data, change the Destination cell to the next empty column (e.g.,

$B$1). - Click Finish.

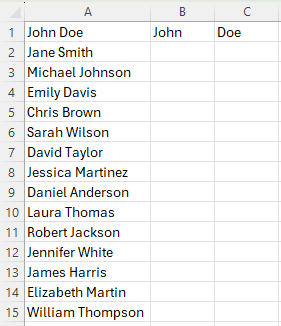

The end result is that the original column has now been split into two.

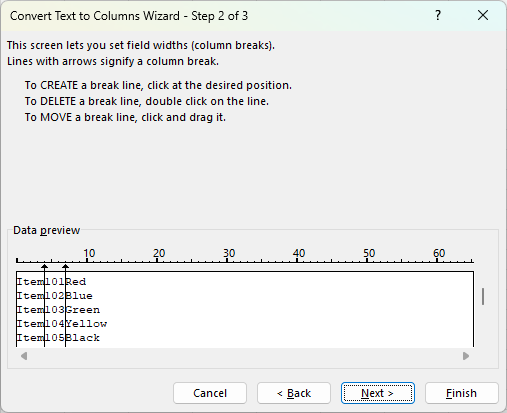

Method 2: Using the Text to Columns Wizard (Fixed Width)

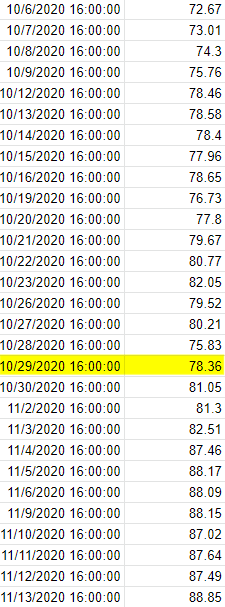

Use this method when your data isn’t separated by a character, but rather organized by specific spacing (e.g., the Product ID is always the first 5 characters, followed by a space, then the Date). In the below example, the first two fields always contain the same length, and there is no delimiter that can break all of them apart.

- Select your data and open Text to Columns.

- Choose Fixed width and click Next.

- Set Field Widths: Click in the ruler area within the Data preview section to create a break line. You can drag the line to adjust the width or double-click to delete it.

- Click Next, verify your format, and click Finish.

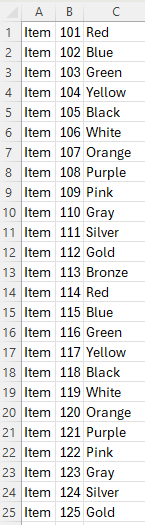

Since the lengths of the first two fields are always the same, using Fixed Widths is an ideal solution in this example. This produces the following result:

Method 3: The Faster Alternative (Flash Fill)

If you are using Excel 2013 or newer, you might not need the wizard at all. Flash Fill uses pattern recognition to do the work for you.

How to use Flash Fill:

- Suppose your data is in Column A. In Column B (the adjacent cell), manually type exactly what you want to extract from the first cell.

- Move to the cell below it and start typing the second entry.

- Excel usually detects the pattern and offers to fill the rest in ghosted gray text. Press Enter to accept.

The Shortcut:

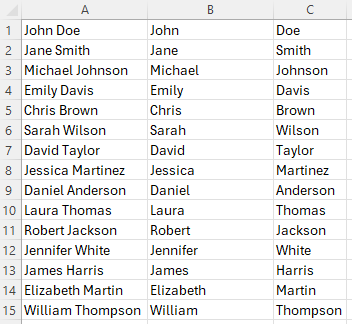

Simply type the first example, click the cell below it, and press Ctrl + E. In the following example, I’ve entered my first values in column B and C, as an example of what my output should look like.

Next, I’ll go to cell B2 and press CTRL + E, and do the same in cell C2. Excel has now automatically filled in the pattern for me:

Method 4: Using Excel Formulas (TEXTSPLIT)

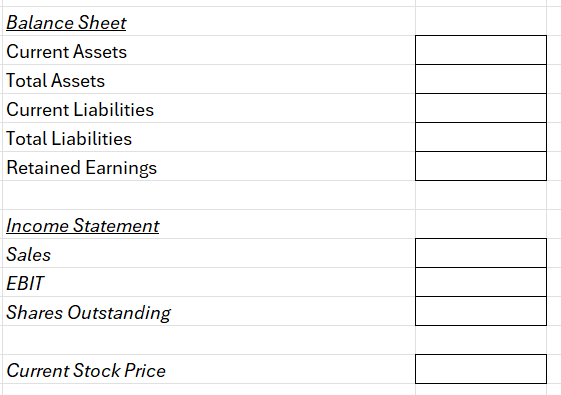

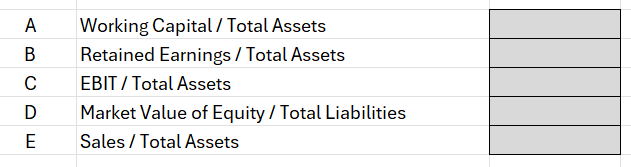

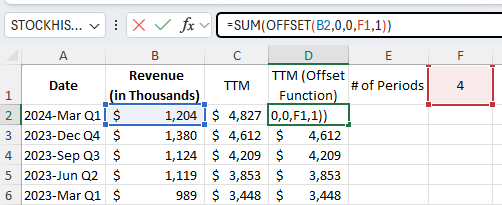

For users with Excel 365, you can use dynamic array functions to keep your data live. If the original text changes, the split columns update automatically.

The formula simply takes two inputs, the range, and the delimiter. In the case of a space being the delimiter, this is what the formula would look like:

=TEXTSPLIT(A2, " ")

This produces the same result as the other methods.

The benefit of this approach is that even if your data changes in column A, the formula will update; there’s no need to redo the flash fill or use the text to columns tool again.

If you liked this post on How to Convert Text to Columns in Excel: The Ultimate Step-by-Step Guide, please give this site a like on Facebook and also be sure to check out some of the many templates that we have available for download. You can also follow me on X and YouTube. Also, please consider buying me a coffee if you find my website helpful and would like to support it.