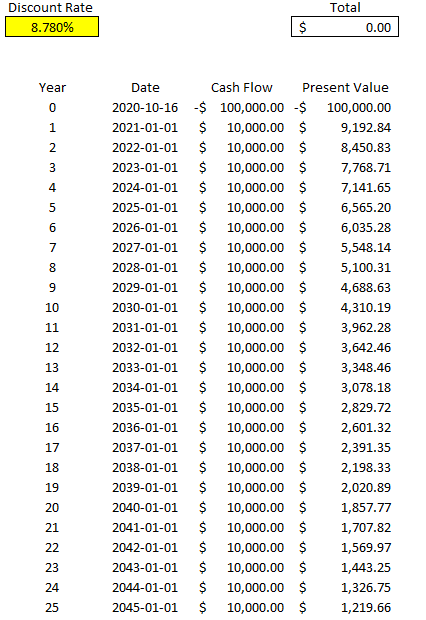

To enter data in the price to earnings ratio calculator, start from top to bottom. Tabbing over or hitting enter will update the calculations.

Price $

EPS $

P/E

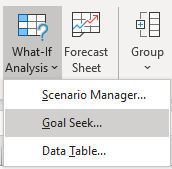

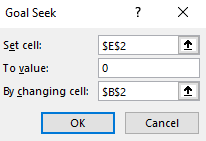

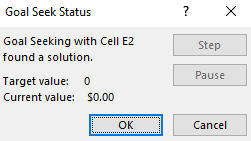

What-if Analysis

Change

to

What P/E is and why it’s important for investors

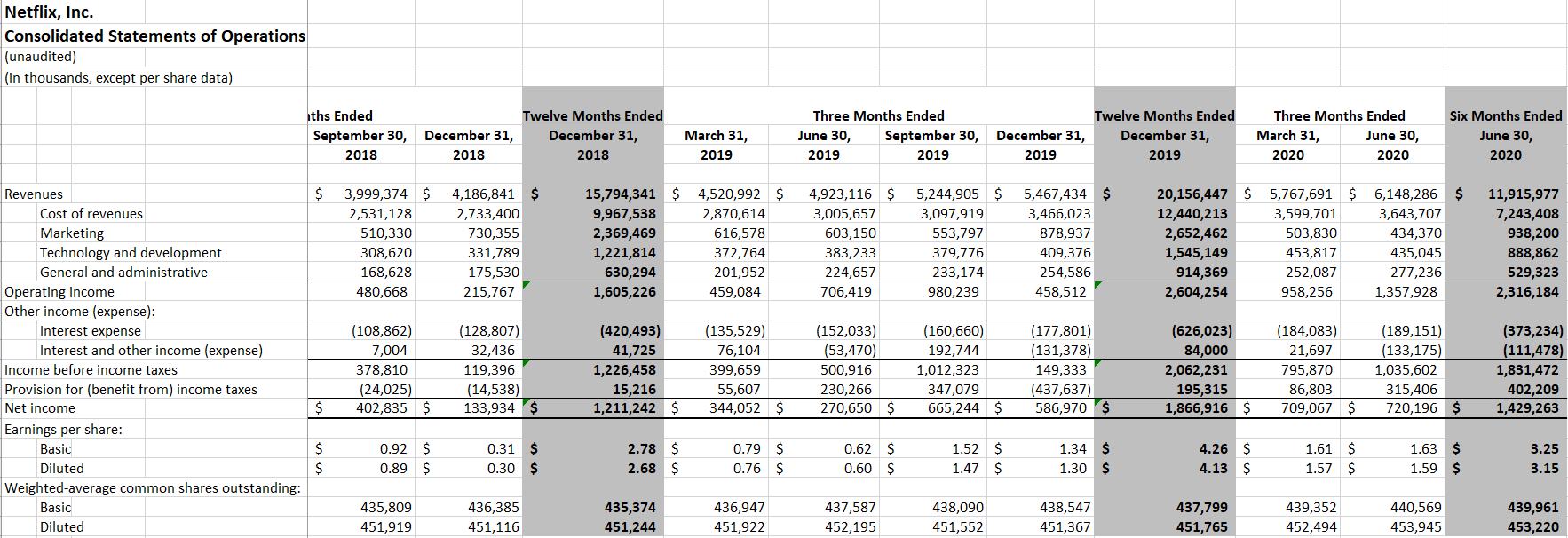

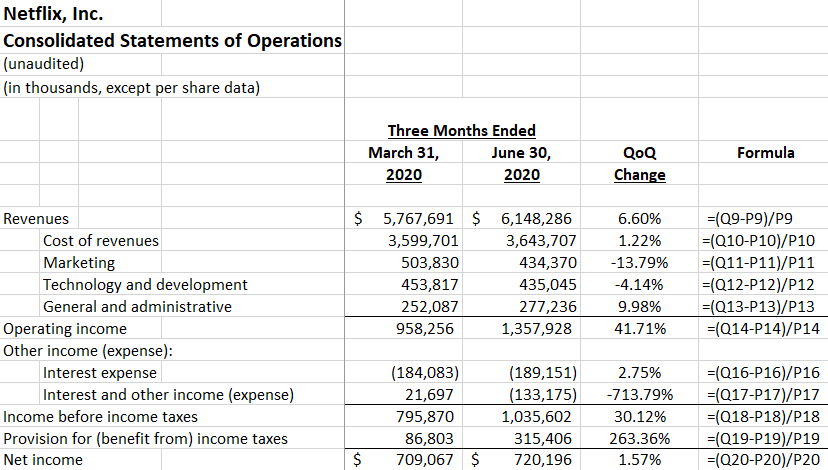

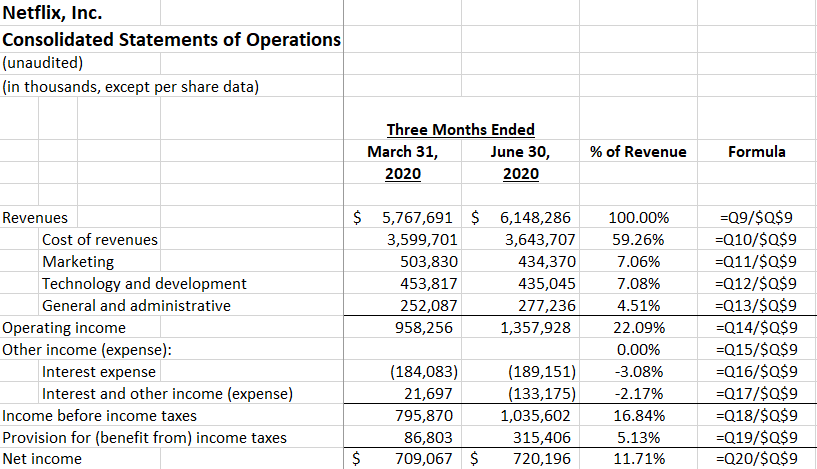

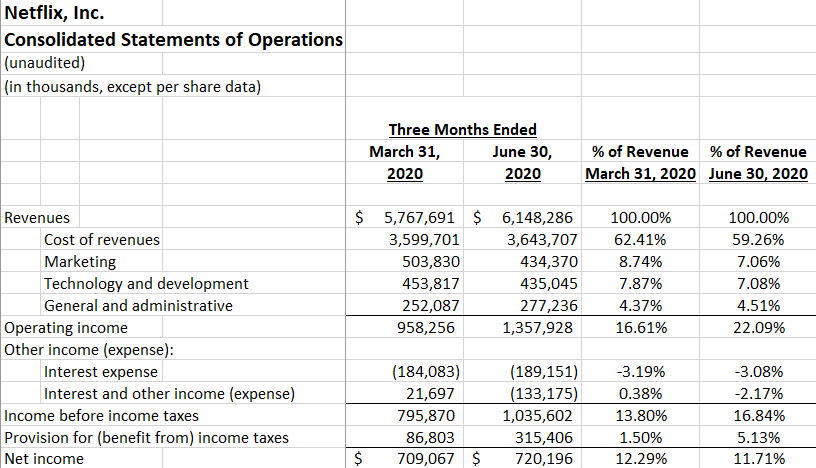

The price-to-earnings (P/E) ratio is a key metric that many investors use when analyzing whether a stock is well-priced and a good buy, given its level of earnings. The calculation takes the current stock price and divides it by the company’s earnings per share, typically over the last four quarters. You can also calculate a forward P/E. This is what the ratio will be in the future, based on estimates of earnings.

This is a particularly useful calculation in a year like 2020 when the coronavirus pandemic has thrown many businesses out of whack and some are over or underperforming. And that means their P/E ratios may not be all that reliable right now.

Using a P/E ratio is particularly useful when comparing one stock against another. If a stock is trading at a very high P/E of 50 or more, it could be a sign that it’s overvalued. However, this can be skewed if a company is coming off a bad quarter where its profits were low. It’s always important to consider the context. And comparing different types of industries may not be helpful, either. A bank stock that is relatively stable and that may not achieve much growth will trade at a much lower P/E than a high-growth tech stock where its sales are climbing by 50% or more.

How to use this calculator

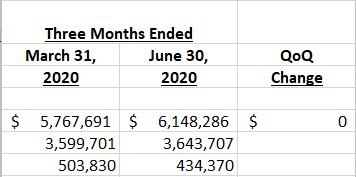

I wanted to create a calculator that could be useful for setting up alerts. For instance, if a stock is trading at a P/E of 50 and you want to set up an alert for when it falls to a lower multiple. You can use the What-if analysis section to plug in the P/E that you want to buy it at. It will then tell you the price it will have to fall to or the EPS that it will need to rise to.

You could also use it as a simple P/E calculator. While many financial websites may give you a P/E number they won’t always update quickly, like when a company reports its earnings. If you know what the new P/E is, you can plug it into the calculator. You can also do a what-if analysis to see what the ratio will be if earnings rises or falls to a certain number.

To enter data into this calculator, you’ll want to start from the top and work your way down. Enter the price and EPS first and then make your selections in the what-if analysis. If you go straight to the what-if analysis then the calculation won’t be correct. As you’re entering data and tabbing over, the formulas will automatically update. Hitting enter after entering in a number will also update the calculation.

Another calculator you may want to try is the average down calculator, which can help you determine how many more shares you’ll need to buy to get your average price down to a specified amount.

If you liked this post on the price to earnings ratio calculator, please give this site a like on Facebook and also be sure to check out some of the many templates that we have available for download. You can also follow us on Twitter and YouTube.