Microsoft Excel is a powerful spreadsheet software that people use for data analysis, calculations, and reporting. While Excel is primarily designed for managing and manipulating tabular data, many users have explored using it as a database. In this article, I will go over the pros and cons of using Excel as a database, highlighting its limitations and advantages compared to SQL and other alternatives.

Benefits of using Excel as a database

1. Familiarity and Accessibility

Excel enjoys widespread usage, and millions of users are already familiar with its interface and basic functionalities. It is easily accessible and requires no additional software or technical expertise to get started. This means no costly support bills as there are many users all over the world who can provide expertise on spreadsheets. And it’s already included in Microsoft 365, which many businesses already pay for.

2. Quick and Easy Data Entry

Excel provides a user-friendly environment for entering and editing data. Its intuitive grid layout allows for easy data input, and its familiar formula syntax enables simple calculations and data manipulation. You can also create templates for data entry so that it is customized to your company’s needs. Through userforms and visual basic, you can even create wizards that walk users through personalized data entry screens.

3. Simple Sorting and Filtering

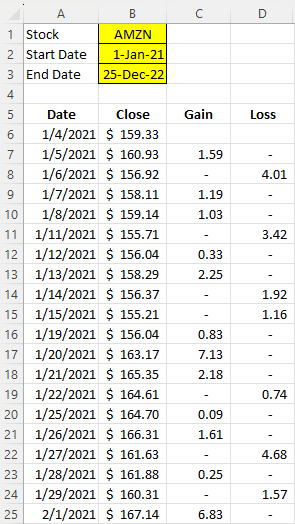

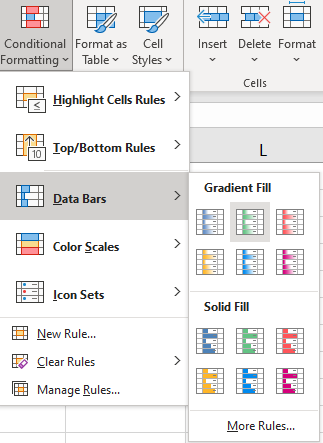

Excel offers basic sorting and filtering capabilities that can be helpful for simple data analysis and organization. Users can sort and filter data based on specific criteria to extract relevant information quickly. This can make it easy to review and analyze data on-the-fly. Slicers also add convenience and can make filtering options even easier, giving users the ability to quickly apply filters with just a few clicks of a mouse.

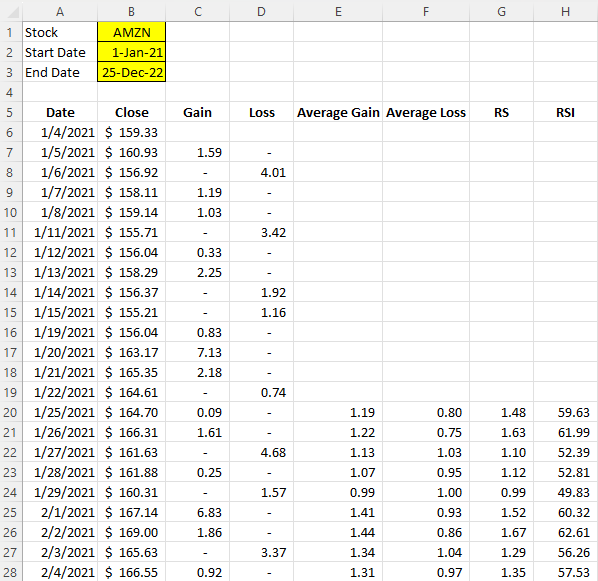

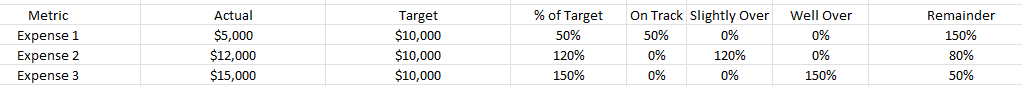

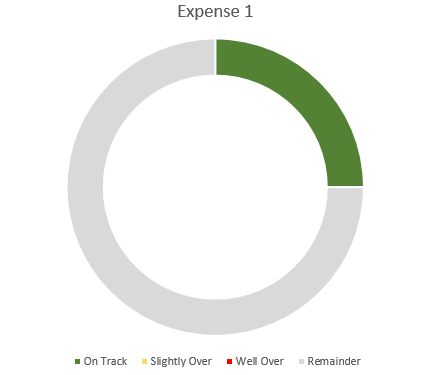

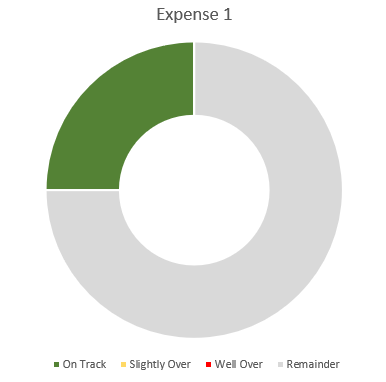

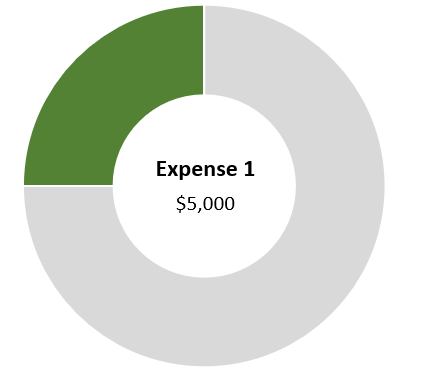

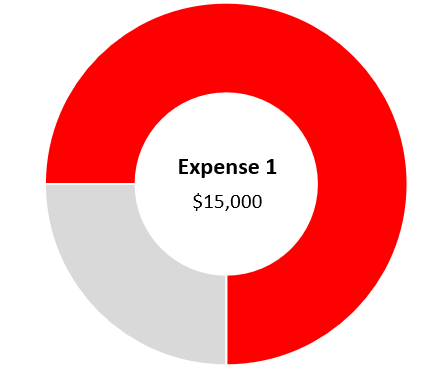

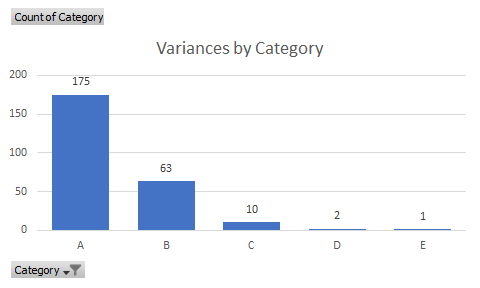

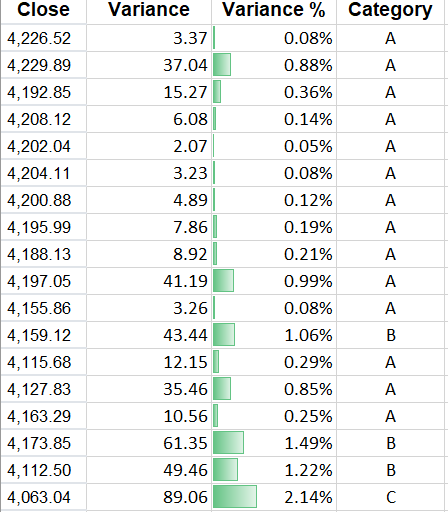

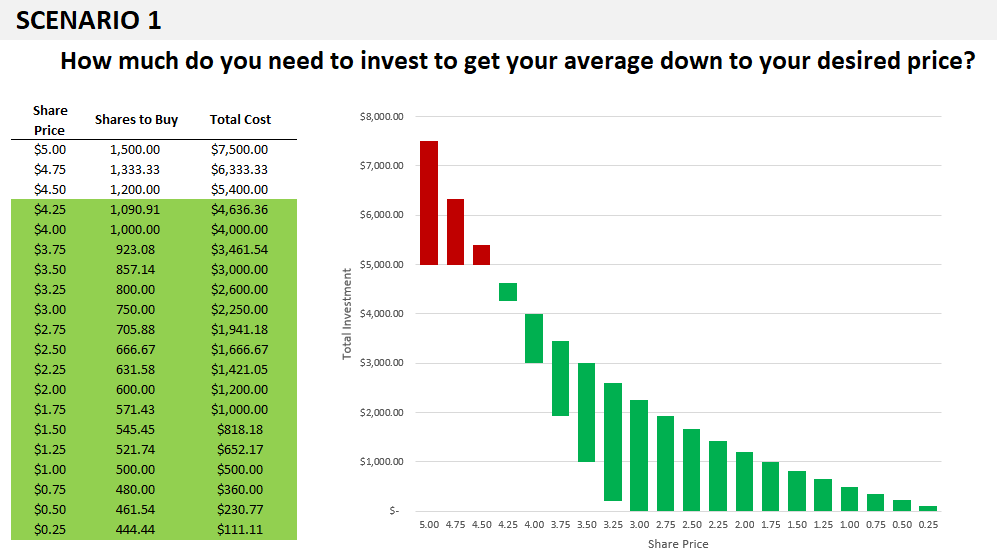

4. Flexible Data Visualization

Excel provides various charting and graphing tools to visualize data effectively. Users can create professional-looking charts and graphs without the need for complex coding or external software. Pivot tables and pivot charts can be created within a few seconds and Excel has many chart templates available that can quickly summarize and display data. You can even create complex 3D bubble charts for more advanced models.

5. Low Learning Curve

Excel’s user-friendly interface and widespread familiarity make it more approachable for non-technical users. In addition to Microsoft’s tutorials, you can find help on message boards, and other websites, like this one, that can help you learn how to use Excel. There are also many YouTube videos covering tutorials as well. Oftentimes, you’ll find users with similar or even the exact problems you are experiencing, making it easy to find a solution with a simple search. In contrast, SQL and other database systems often require specialized knowledge and training.

6. Cost-Effectiveness

Excel is usually included in the Microsoft Office suite, which is commonly available in many organizations. Dedicated database systems may require additional licensing costs and infrastructure investments. With Excel, you just pay a recurring fee for Microsoft 365. And if you have an older off-the-shelf Excel product, you can use it indefinitely without having to pay a subscription fee.

7. Quick Prototyping and Ad Hoc Analysis

Excel’s ease of use allows for rapid prototyping and ad hoc analysis. Users can quickly create and modify data structures, perform calculations, and experiment with different scenarios without complex setup or formal data modeling.

Disadvantages of using Excel as a database

1. Limited Scalability

Excel is not designed to handle large datasets or complex data relationships. It has a practical limit on the number of rows (1,048,576 in Excel 2019) and can become sluggish when dealing with vast amounts of data. Additionally, as the file size grows, it can lead to performance issues and increased chances of data corruption.

2. Lack of Data Integrity and Security

Excel lacks built-in mechanisms for ensuring data integrity and enforcing strict security measures. It offers limited data validation features and minimal control over user access and permissions. This makes it prone to human errors, accidental data modifications, and unauthorized access. While macros, locked cells, and additional controls can be added to make a file more sure, they’re by no means ironclad; if you need to keep information confidential, then it’s best not to hold the data in Excel.

3. Lack of Concurrent Access and Collaboration

Excel files are typically stored on local machines, making it challenging for multiple users to collaborate simultaneously. Sharing and managing Excel files across different users can lead to version control issues and data inconsistencies. And if you’re using macros, then multiple users cannot be in the same file at once. This is one of the biggest drawbacks of trying to use Excel as a database and it’s one of the first questions I ask people who want to create a file that multiple people are using — do they need to be in it at the same time? If so, then Excel isn’t the right solution.

4. Limited Data Analysis and Reporting Capabilities

Excel’s analytical capabilities are limited compared to dedicated database systems like SQL. It lacks advanced querying capabilities, complex aggregations, and data mining functionalities, which can hinder advanced data analysis and reporting needs. While advanced users can create complex and custom reports, for those who aren’t comfortable doing it themselves, they may prefer using a different system.

Should you use Excel as a database?

Excel has lots of great functionality and by now it should be clear that you can use it as a database. However, the more important question is whether you should do so. There are three questions you can ask yourself to help make that decision:

- Do multiple people need to be in the file at the same time?

- Do you have a large database that may require more than 1 million rows in a single table?

- Are you holding sensitive information (e.g. credit cards, social security numbers) in your database?

If you answer yes to any of those questions, then Excel probably isn’t going to work for you. But if you answered ‘no’ to all of them, then you may benefit from storing your data in Excel and using it as a database.

Regardless of what IT experts may tell you, there are situations where Excel can be used as a database and where it makes sense to do so, especially when the alternative is a costly system which requires ongoing maintenance and where support can be expensive.

If you liked this post on Whether You Can Use Excel as a Database, please give this site a like on Facebook and also be sure to check out some of the many templates that we have available for download. You can also follow me on Twitter and YouTube. Also, please consider buying me a coffee if you find my website helpful and would like to support it.